4 Weeks of Session Remaining I believe our job as legislators includes making sure schools are safe, secure and welcoming. The number one cause of death for student athletes is sudden cardiac arrest, and I am pleased to report the Senate third read and passed Senate Bill 166 & 155 to address this issue. This bill requires Missouri schools to have response plans in place for cardiac incidents both during school hours and at school-sponsored events. This legislation requires trained school staff to work with local emergency services to integrate cardiac plans in their schools and local emergency service protocols. Cardiac emergency response plans can increase sudden cardiac arrest survival rates by more than 50%, and I believe SB 166 & 155 will save lives. This bill was sent to the Missouri House of Representatives for further consideration. House Bill 594 & 508, called the capital gains tax cut bill, passed the Senate on April 7 and was sent back to the House with changes for a final vote before heading to the governor or being referred to committee. I believe calling it a capital gains “tax cut” is misleading because Missouri does not have a capital gains tax, so there is nothing to eliminate. There are several provisions included in this bill, some I believe are good and some I have concerns about. One good provision is the inclusion of the Senior Citizen Property Tax Relief Credit, commonly known as the “circuit breaker.” This helps elderly adults and Missourians with disabilities living on fixed incomes stay in their homes longer by providing them with a credit toward the cost of their property taxes. This is important because income eligibility guidelines and tax credit amounts have not been changed since 2008 and desperately need to be updated because housing costs, property taxes and inflation have significantly increased since then. One of my bills, Senate Bill 64, matches some of the language in this current bill regarding the circuit breaker. Another good provision would eliminate the state sales tax on diapers and feminine hygiene products. These products are essential items, not luxuries, and should be exempt from sales tax. As it stands, HB 594 & 508 would make individuals immediately eligible for a capital gains tax cut. General revenue from the state of Missouri would be taken and used to reimburse individuals and LLCs who pay the federal capital gains tax. I am concerned about the long-term implications of this. However, another small win in this bill was that corporations will be delayed from taking advantage of this capital gains tax cut. In the original bill, corporations would have been allowed to get immediately reimbursed for their federal tax liability on capital gains. Changes made to HB 594 & 508 by the Senate’s minority party will delay this tax cut until Missouri’s individual income tax rate is 4.5%. Kudos to District 24 Constituents! Congratulations to Nora Schroeder, a junior at Kirkwood High School, who won second place in the C- Span StudentCam Competition for her documentary, “The Radioactive Waste Crisis: A Hidden Hazard.” So much hard work and research went into her project. It is so honorable that she used her voice to help bring awareness to this crisis occurring in St. Louis. You can read more about it on c-span.org.

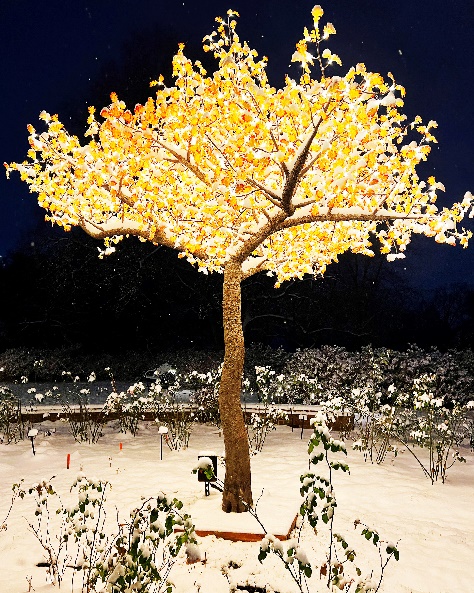

Congratulations to Dawson Braden, a senior at Ladue High School in St. Louis, who was honored at a special ceremony on April 10, 2025, in the Capitol Rotunda. I selected Dawson’s artwork titled “Garden Glow Tree” to represent District 24 in the 2025 Senate Art Exhibit. Established in 2014 as a joint effort between the Missouri Art Education Association and the Missouri Alliance for Arts Education, the Senate Art Exhibit showcases fine arts programs and aspiring young artists from all 34 Missouri senatorial districts. The Senate Art Exhibit will be on display from now through March 2026 in the Missouri State Capitol.

MOST: Missouri’s 529 Education Plan MOST, Missouri’s 529 Education Plan, has been helping families set their loved ones up for success for 25 years and counting. With a MOST 529 Account, Missouri residents can enjoy: - Flexibility to use savings nationwide for eligible colleges, universities, vocational and trade schools, graduate programs and even tuition associated with K-12 public, private and religious institutions.

- A state tax deduction of up to $8,000 per person ($16,000 if married or filing jointly).

- Tax-free withdrawals when used for qualified expenses.

Additionally, there is no minimum deposit requirement to open a MOST 529 account, making it easy and accessible for families to take the first step toward saving for their child’s education. For more information, visit missourimost.org. Contact Us If there is anything I or my amazing staff, Hannah Dolan and Emily O’ Laughlin, can do to assist you, please call 573-751-9762, email tracy.mccreery@senate.mo.gov or visit us in State Capitol Room 427. If you would like updates more often, please visit my senate webpage at senate.mo.gov/McCreery or visit youtube.com/mosencom to view weekly updates from my office. |